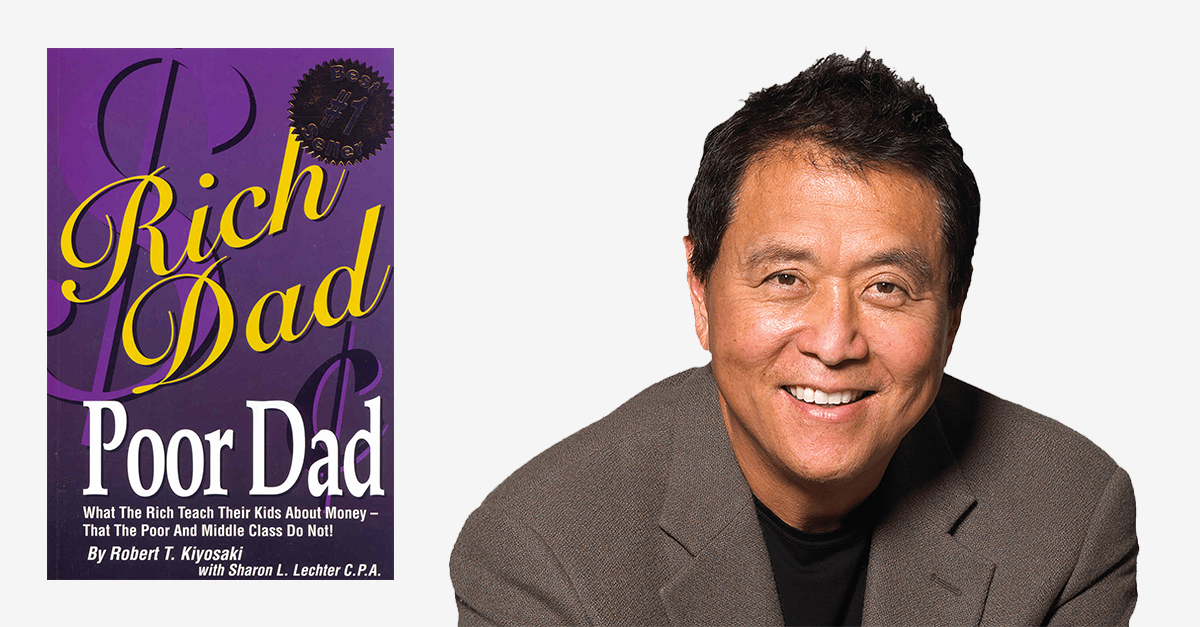

Many, years ago, I read Robert Kiyosaki’s Rich Dad, Poor Dad. For those who haven’t read the book, it’s a fictional story of Robert’s experience growing up with a father who worked hard at a salaried job and his friend’s father who was an entrepreneur. Throughout the course of the book Mr. Kiyosaki highlights the benefits of investing in real estate as long as its cash flows are positive. Meaning after the mortgage, property taxes, utilities and maintenance fees are paid for, there is money left over from the rent collected on the property.

Robert Kiyosaki feels that because the investment property cash flows are positive, you own it. I agree with him there. I’m a huge believer in investing in real estate to increase your wealth now and into your retirement. This book had a huge impact on me becoming the successful real estate investor that I am now.

Where I disagree with Robert Kiyosaki is that he feels that your home is not an asset. His rationale is that the bank owns it as you are solely responsible for covering the mortgage on your home. I disagree because I feel that your home is an asset. In fact, for most people, it’s the only asset they own. The property values in Toronto have risen so much that for most homeowners. They have doubled the value of their property within 6-7 years. Additionally considering most of those people put down 20% or less as a down-payment. The upside they witness is simply life-changing.

Picture this

In 2008, you paid $630,000 for a semi-detached house in North Toronto. In 2017, that same house is worth $1,350,000. You put a down-payment of less than $130,000 to purchase the home. Now you have made $720,000 in 9 years on your investment of less than $130,000. A return of well over 450% on your money. That sounds like an asset to me!

I agree with Robert Kiyosaki on the benefits of investing in real estate. However, I disagree with him when he says, “your house is not an asset”. I would happily take that asset any day, thank you very much.