Just when you thought that it couldn’t get any more expensive to buy a house or condo in the City of Toronto, and wham! Not only are Property Taxes increasing, so are Land Transfer Taxes.

City of Toronto Council has approved changes to the Toronto Land Transfer Tax that result in additional Toronto Land Transfer Tax costs for some home buyers with a closing date on or after March 1, 2017, when it will be harmonized with the provincial Land Transfer Tax (LTT).

Status

The following changes to the Toronto Land Transfer Tax were considered and approved by Toronto City Council on February 15, 2017. The changes are effective AS OF MARCH 1, 2017, for real estate transactions closing on or after this date:

- Added an additional LTT of 0.5% value of a residential or non-residential property from $250,000 to $400,000 (additional $750)

- Additional LTT of 0.5% value of a residential property above $2 million

- Additional LTT of 0.5% value above $400,000 of a non-residential property

Property Taxes

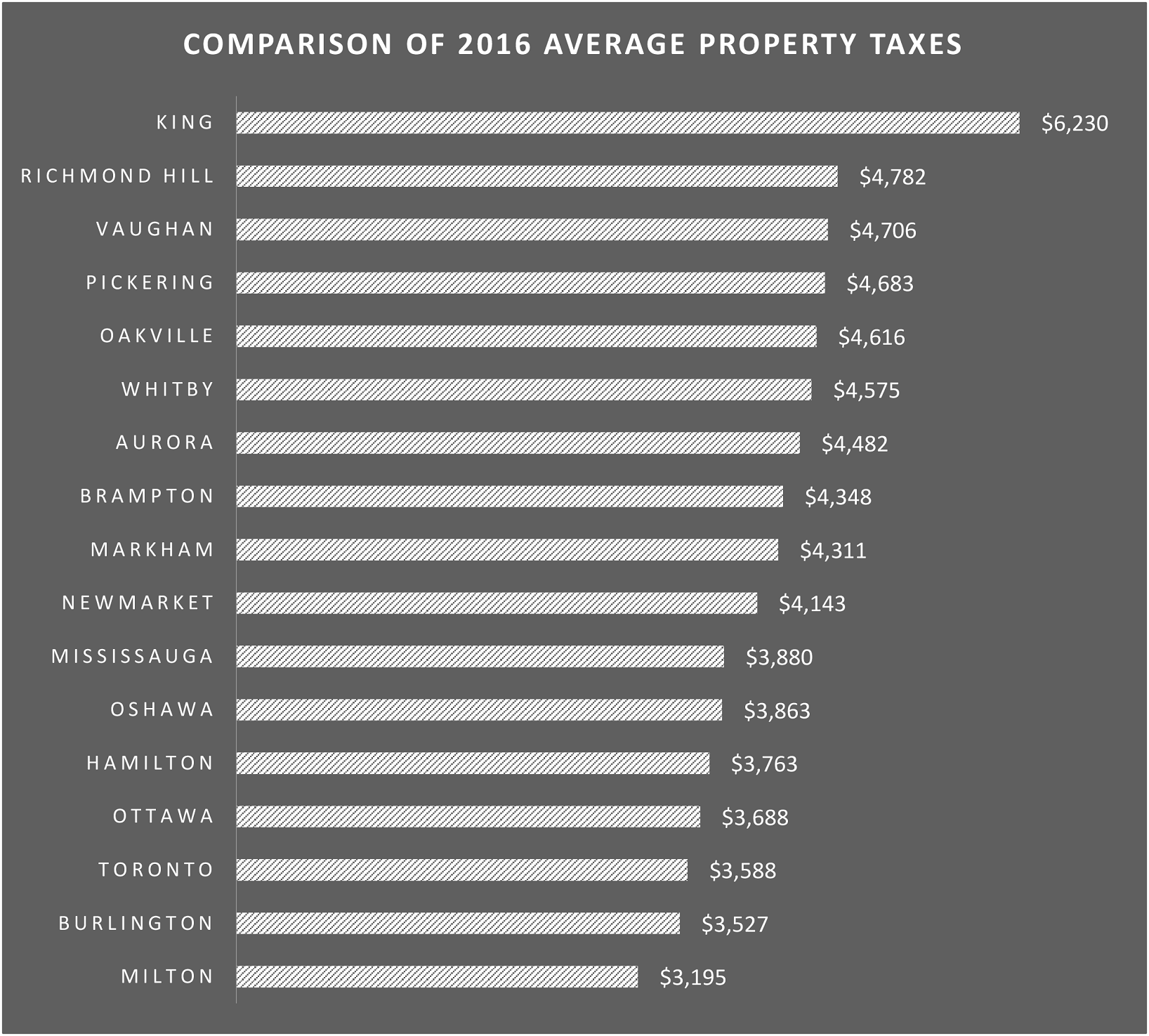

Furthermore on the property tax front, Toronto’s City Council has approved a 2% increase for residential property taxes for 2017. The Councillors feel that a 2% increase is below the rate of inflation so it won’t be too much of a hardship for home & condo owners. The increase will go towards funding for the City’s shelters. Our city still pays lower property taxes than the 905. Richmond Hill, Brampton & Mississauga pay far more in property taxes and only Burlington & Milton pay less in property taxes.

First-Time Home Buyer Rebate

Luckily, there was a slight bit of good news for first-time home buyers. The rebate for Land Transfer Taxes for the municipal portion has increased up to $4,475, up from $3,725. The maximum rebate for the provincial portion of the land transfer tax is $4,000. The Council also amended the first-time home buyer rebate program eligibility rules. This will restrict rebate eligibility for Canadian citizens and permanent residents of Canada.

That, in a nutshell, are all of the changes that will affect first-time home buyers.

If you have any questions/comments, feel free to reach out to me.

Phone: 416.509.3286 | Email: Davelle@BosleyRealEstate.com