Have you noticed mortgage rates are slowly climbing their way up? If you’re looking to purchase house, condo or investment property in the next year, take note. These rate increases will directly affect your purchasing power.

Of course, no one ever has a crystal ball when predicting what will happen next with the economy.

In a recent speech by the Bank of Canada’s Governor, Stephen Poloz, he stated,

“Let me conclude by pointing out that, even with last week’s increase in the policy rate to 1.75 per cent, monetary policy remains stimulative. In fact, the policy rate today is still negative in real terms, that is, once you adjust for inflation. Our estimate of neutral is in a range—currently 2 ½ to 3 ½ per cent. The policy rate will need to rise to neutral to achieve our inflation target. That said, the appropriate pace of increases will depend on our assessment at each fixed announcement date of how the outlook for inflation and related risks are evolving. In particular, we will continue to take into account how the economy is adjusting to higher interest rates, given the elevated level of household debt,”

In addition, I recently attended the AGM of the Toronto Real Estate Board (TREB), where Benjamin Tal, Deputy Chief Economist of CIBC World Markets Inc also felt that rates would be going up.

Now that we’ve established that rates are in the incline.

How will this affect your ability to get what you want?

Let’s take a look at these examples, let’s say you’re purchasing a property for $600,000. If you put 20% down, the monthly mortgage payment based on a 25 year amortization based on a 3.62% rate of interest will be $2,427. If the rate increases to 3.84% (which it is now with some lenders), the mortgage payment will be $2,484. If the rate increases to 3.96%, the mortgage payment becomes $2,515. As rates climb and becomes 4.05%, the mortgage payment becomes $2,534. If the rate climbs to 4.14%, the mortgage payment becomes $2,562.

You can see how after 2 interest rate hikes, which is what’s predicted to happen in 2019, a $50 monthly difference which would translate to an increase of $600 each year.

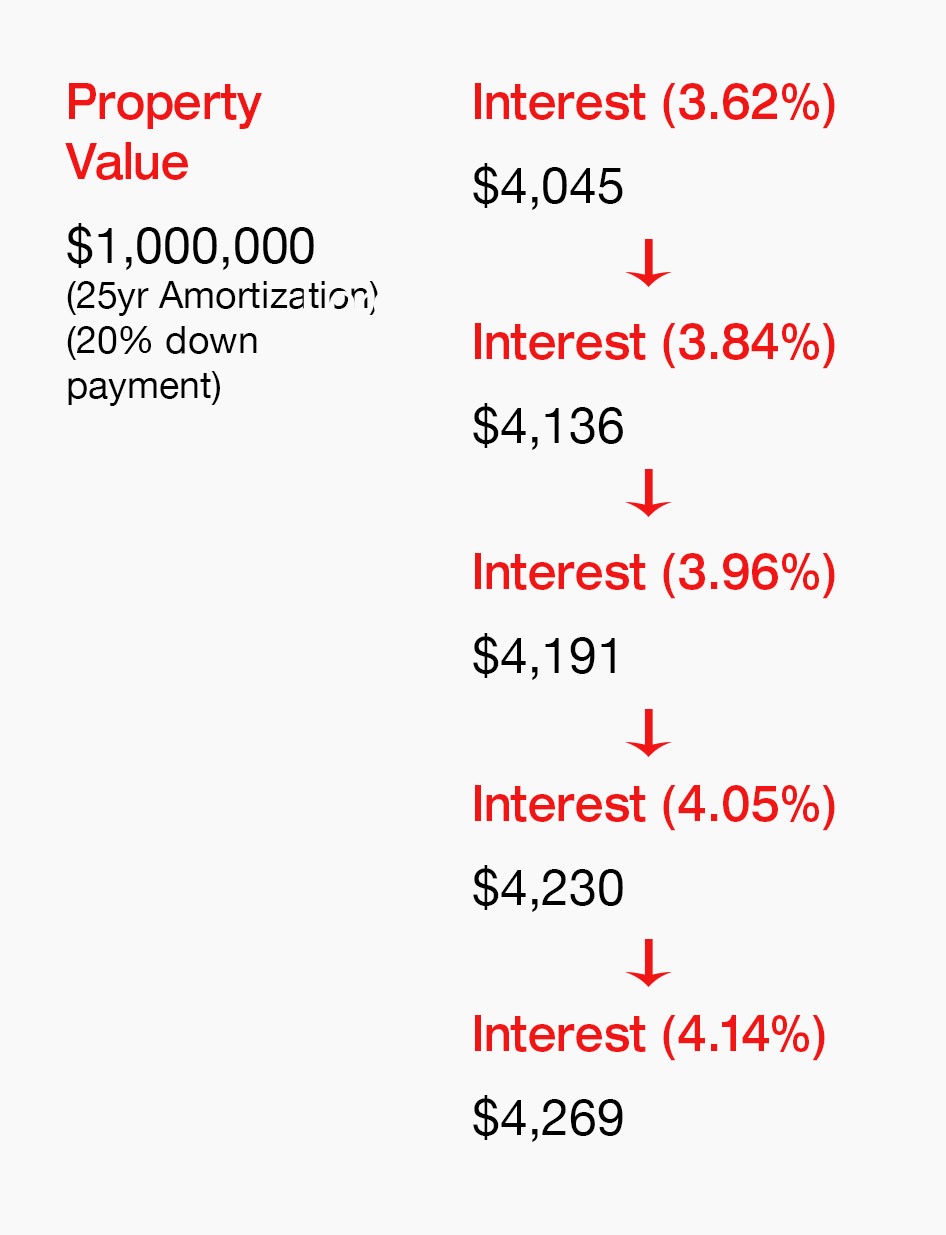

Now what if you’re looking at purchasing a $1 million property how do those numbers look? If you put a 20% down payment, the mortgage payment based on a 25 year amortization based on a 3.6% rate of interest will be $4,045. At 3.84%, the mortgage payment is $4,136. At 3.96%, the payment is $4,191. At 4.05%, $4,230 and at 4.14%, the monthly mortgage payment becomes $4,269.

After 2 interest rate hikes, your monthly mortgage payments increase by $94 and which would translate to an increase of $1,100 each year.

In addition to making your payments more expensive, it will change how much of a mortgage you can afford, in effect reducing the size of the property that you could purchase.

For real estate investors, it can be the difference between a property cash flowing positive or not making any money at all.

It’s definitely something to consider as 2018 draws to a close. How much of a mortgage can you afford at today’s rates and how much you can afford will change as rates slowly rise?

What should you do? Meet with a mortgage broker to go over your options so that you can see how the coming rate increases will affect you and your buying power.

Contact me at 416.509.3286 or davelle@bosleyrealestate.com