How many semi-detached houses are selling for more than $1.4 million?

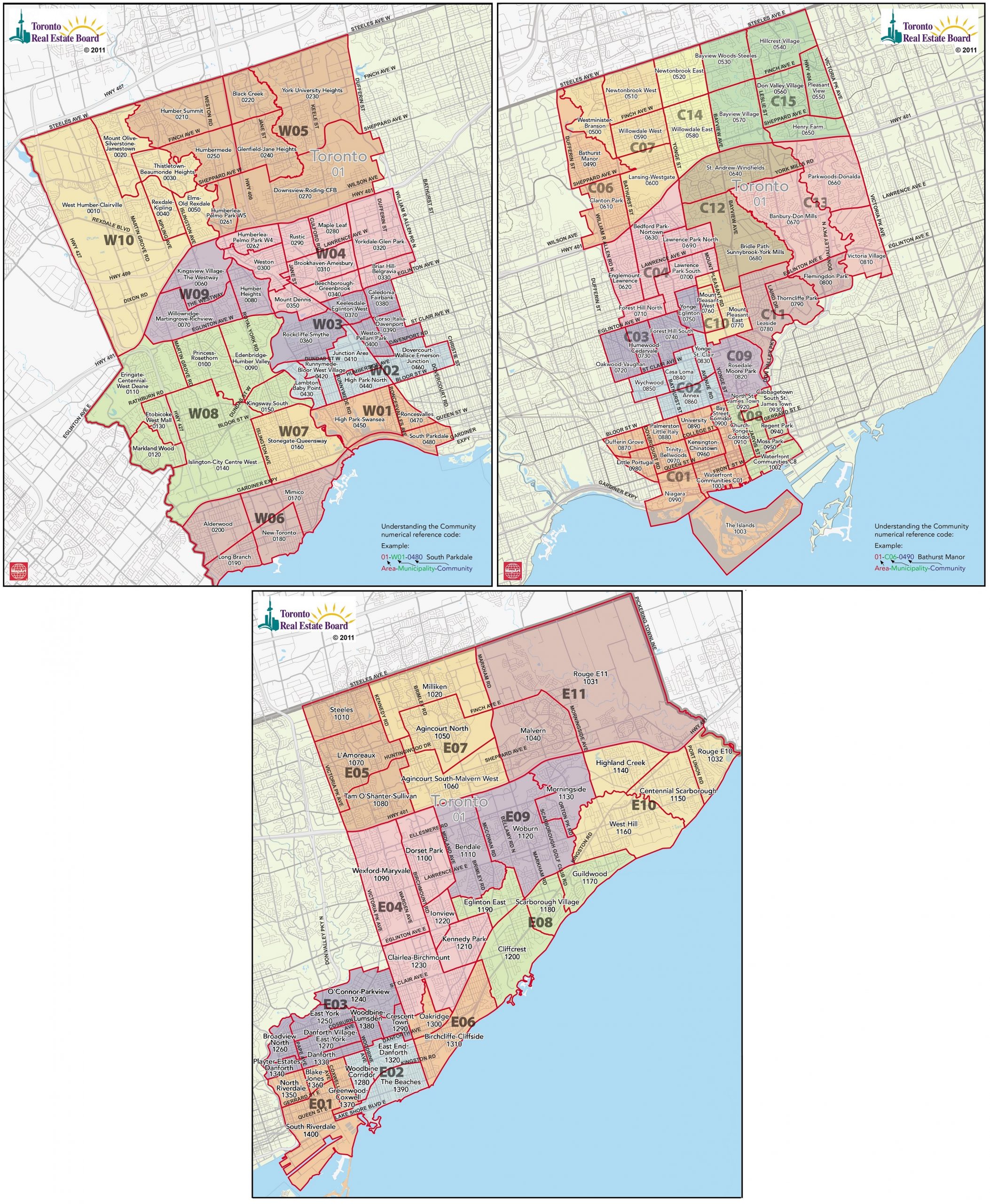

Over the last few weeks, I’ve noticed a trend with the prices of semi-detached houses in the core (C01, C02, C03, C04, C08, C09, C10, C11, E01, E02, E03, E06, W01, W02, W03 – see below for map) of Toronto. Pricing trends in the real estate market tend to be gradual but what I’m noticing seems like a more drastic trend. It’s an upward trajectory on the prices of semi-detached houses in Toronto. Many home buyers will now be shut out of the semi-detached housing market and more likely to buy condos.

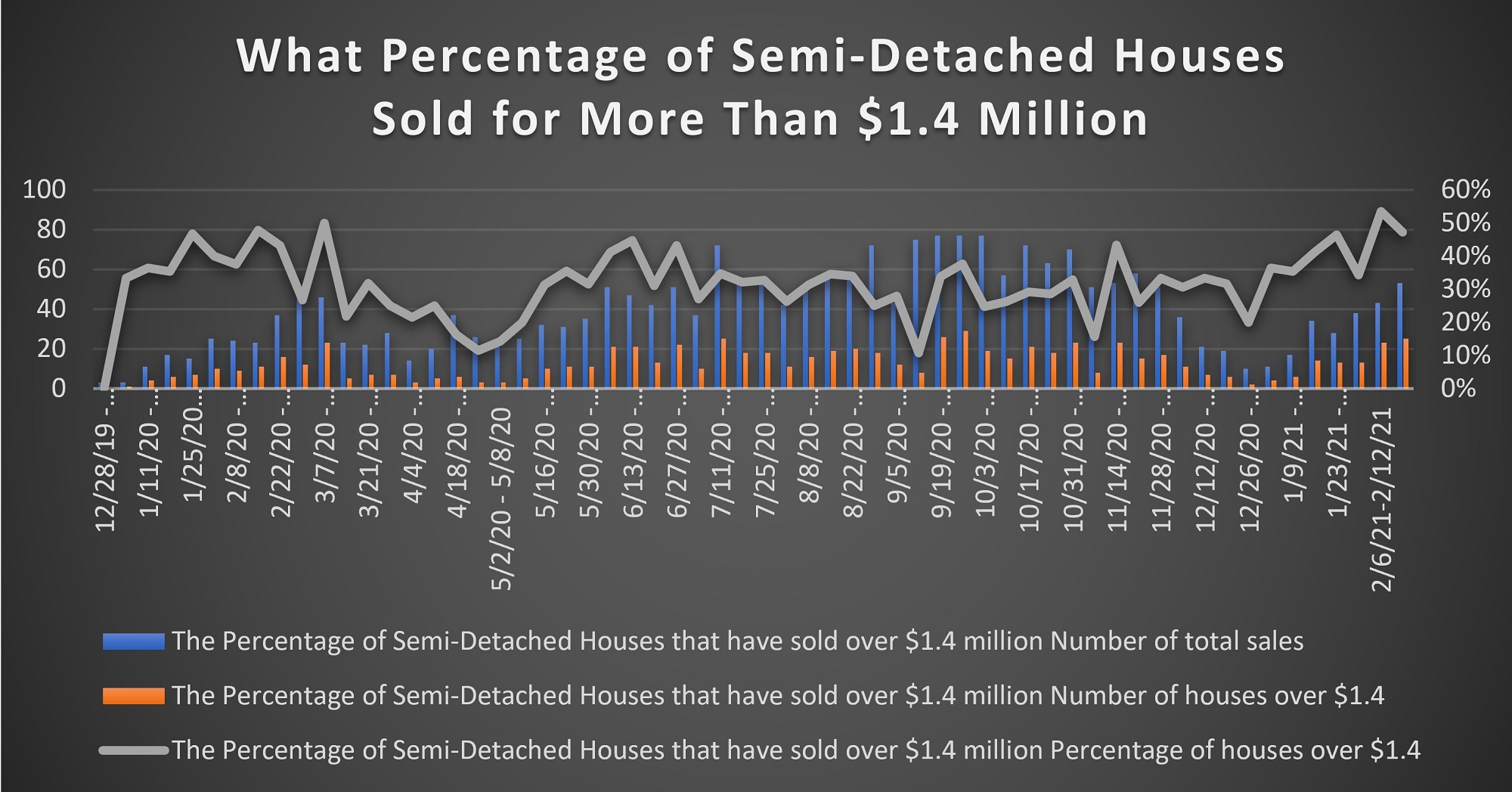

Over the last few weeks, I’ve noticed more semi’s (as their affectionately called) selling for more than $1.7 million. That’s a lot of money for a semi-detached house. So I thought I would look into the numbers a little further. I took a look at how many semi-detached houses sold each week over the last year and how many of them sold for more than $1.4 million.

The trend is a dream for some and a nightmare for others. In January 2020, more than 30% of the semi-detached houses that sold, were sold for more that $1.4 mill. What’s interesting is that the week before last year’s lockdown, the week of March 15th, 50% of semi-detached houses sold for more than $1.4 million.

During our lockdown at the beginning of May only 12% of the semi-detached homes sold, were sold for greater than $1.4 mill. Then as sales picked up over the summer, we started to see numbers as high as 45% of the semi-detached houses in June sold for greater than $1.4 million. In the fall, the percentage of semi-detached houses that sold for more than $1.4 mill dipped down to 30% again.

Source: TRREB Toronto Regional Real Estate Board

The 2021 trend seems to be clear, prices are increasing from where things left off pre-covid last year.

Interest rates will be low for at least another year.

Money is cheap and people want more space.

Since most of us are spending 95% of our time in our homes, most of us want more space.

In the last few weeks, we’ve seen a trend of 46%, 47% and 50% of semi-detached houses selling for greater than $1.4 million. The new price benchmarks are being set.

While this new pricing is a dream for homeowners, for many who don’t own a home yet, it will certainly force many buyers back into the condo market.

Communities in Toronto