I’ve heard a lot of people comment that when those mortgage deferrals end, the housing market will be in trouble. Well it’s the end of October now and the market hasn’t collapsed.

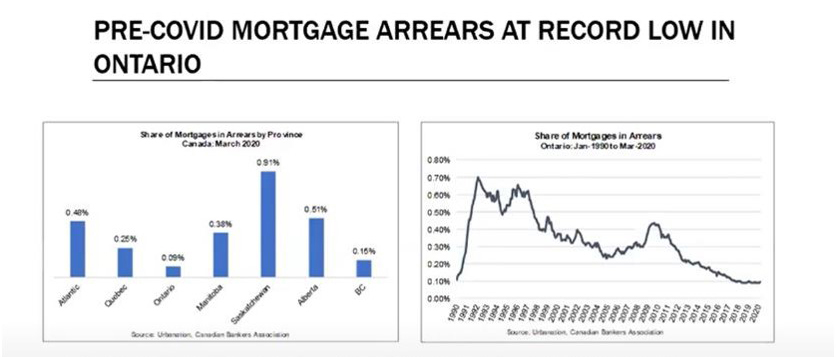

The mortgage delinquency rate across Canada pre-covid was 0.29% and in Toronto where real estate is the most expensive, the rate was 0.11%, which is incredibly low.

I recently attended a presentation where Shaun Hildebrand from Urbanation highlighted some interesting statistics.

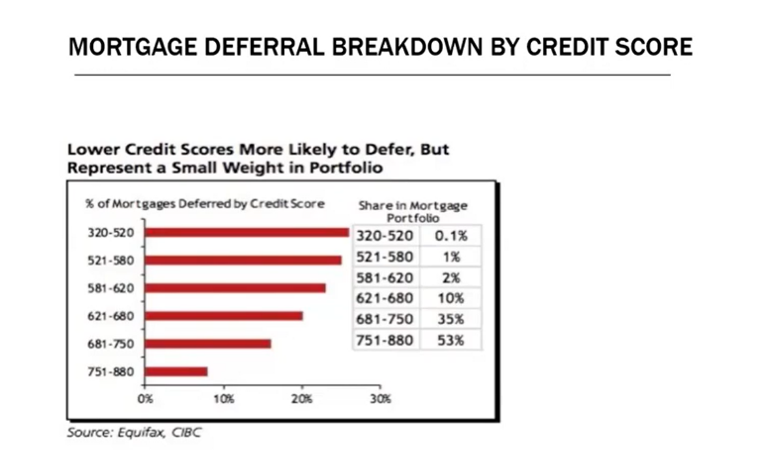

At the end of June 2020, 760,000 Canadians (roughly 16% of mortgage holders) had taken advantage of the mortgage deferral programs.

What’s interesting is that a few months into the pandemic, many mortgage holders decided they would continue to pay their mortgage payments as their financial situation wasn’t as dire as they had first thought.

What was really interesting about Urbanation’s numbers is that the HIGHER your credit score, the less likely you were to defer your mortgage. The LOWER your credit score, the less likely you were to hold a mortgage. 53% of mortgage holders have a credit score between 751-880.

What does this mean to me? That most people who deferred their mortgage won’t be skipping any payments when their mortgage get re-instated.

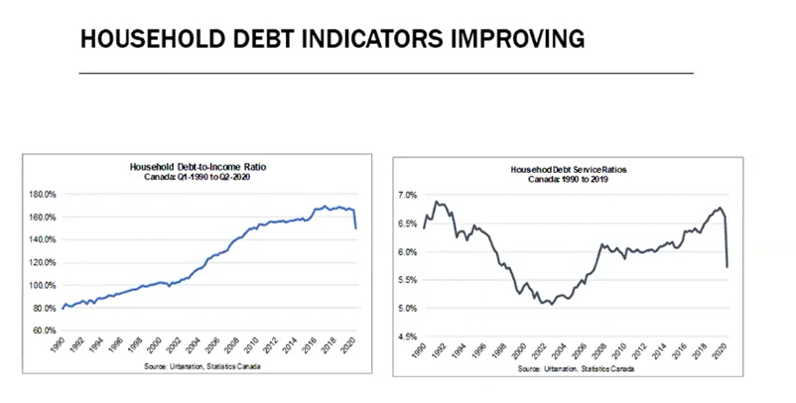

I also find interesting is that since March 2020 household debt levels have been declining. It turns out the household savings rate at the end of 2019 was 3.9% and it has soared to 28.2% in June 2020.

It turns out when people can’t leave the house and have nothing to spend their money on except for essentials, they save money and pay off their consumer debt.

So for all the reasons above, I don’t see a large number of home owners bailing on their homes and triggering a crash. There are definitely many people who have suffered hardship during the pandemic lockdowns but there are a number of people who have been saving money and doing just fine thank you so the housing market should stay the course.